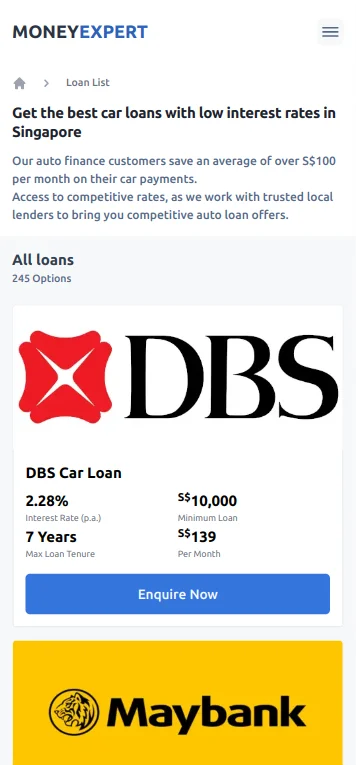

Compare car loans easily and affordably

Find the best rates. Save time and money.

Darren

7 August, 2022I am very impressed, I was able to get a great rate and managed to get approved within minutes

Frequently Asked Questions

MONEYEXPERT is the best place to look for car financing options, and everything related to car buying.

How do I apply for an auto loan?

It's easy to find and apply for the best car loans in Singapore. Go to our list of car loans, compare the offers and enquire on the ones your prefer.

How much car loan can I get?

The maximum amount you can get from a car loan is either 70% or 60% of your car’s open market value (OMV):

- Motor vehicle with OMV ≤ S$20,000: maximum LTV is 70%

- Motor vehicle with OMV > S$20,000: maximum LTV is 60%

That said, you may or may not receive the full loan amount you’re hoping to get. The bank or financial institution will take into account your other debt obligations and repayment ability before deciding on the amount of car loan you can qualify for.

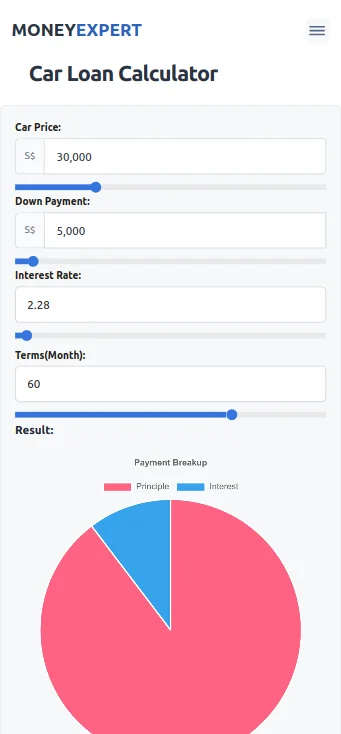

How is interest calculated on auto loans in Singapore?

Car interest rates are calculated on a flat percentage per year on the full loan amount, and this interest is multiplied by the number of years of the loan tenure.

Unlike most property loans, the interest is not reducing each successive year but is flat throughout. The percentage stated on your car loans adds up to a larger amount when compared to property loans showing the same interest rates, for the equal amount loaned.

Therefore, it is important you compare and shop around for a car loan with the lowest rates.

How much do car loans cost in Singapore?

How much interest a car loan will cost you depends on the amount you borrow, the interest rate and the duration of your loan. MoneyExpert has selected trusted lenders with some of the bests rates in Singapore. You can see their loan rates on our car loans comparison page. You can then use our car loan calculator to easily estimate how much total interest you will have to pay over a certain loan. Once you have selected a lender and enquired for a loan, it is important that you confirm the costs and terms of the loan with them.

Can I get a car loan to buy a used car?

Yes, you can apply for a car loan to purchase a used car. You may borrow the full amount of the car cost, or make a down payment and borrow the remaining amount. You can send an enquiry to one or multiple lenders from our selection to get more details on the terms of your used car loans.

Can I refinance a car loan?

Borrowers can refinance their motor vehicle loan up to the full outstanding amount and a maximum tenure of (7 minus X*) years or for the duration of the COE validity if they meet the lender’s credit assessment. The same calculation applies to new or used motor vehicles

*X is the number of years since the motor vehicle loan was first disbursed.

Have any additional questions?

Get in touch, one of our experts will be happy to answer your questions.

Get in touchDon't miss the latest tips and offers

Stay in the loop with everything you need to know.